CMS-1561 2001-2026 free printable template

Show details

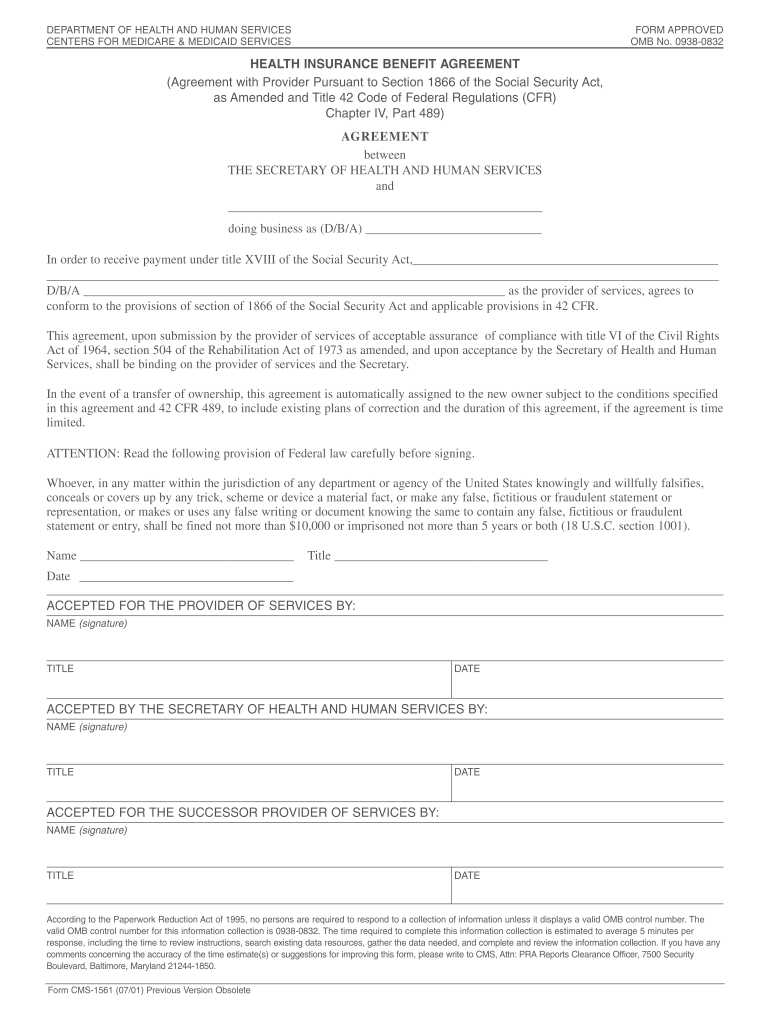

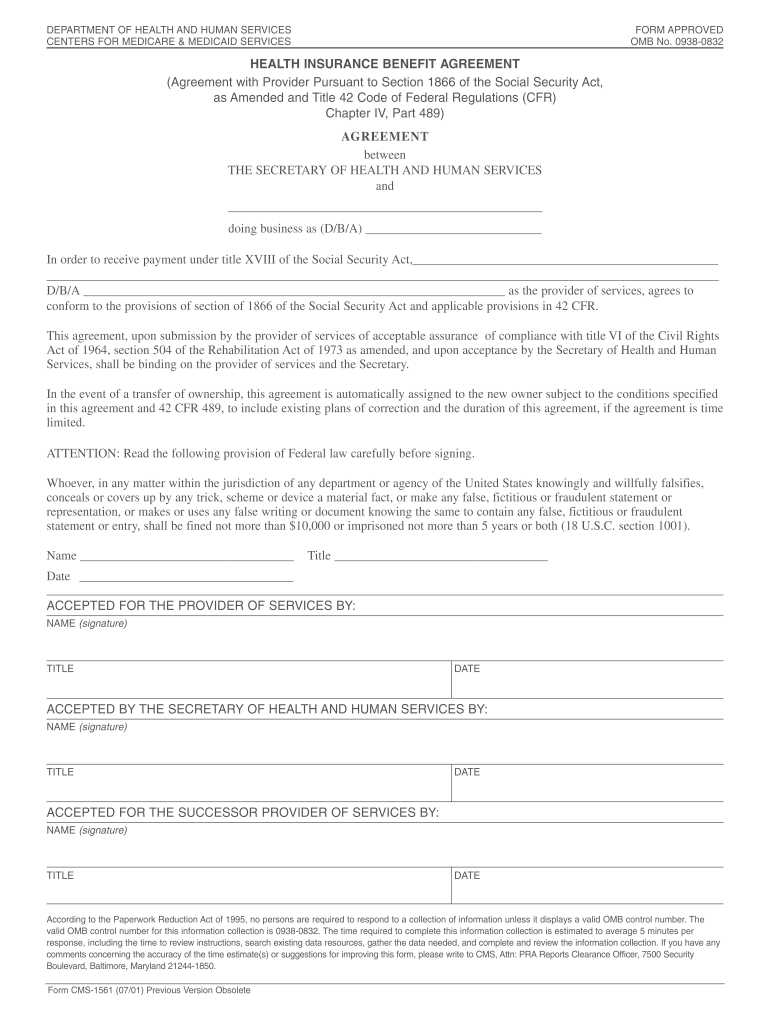

DEPARTMENT OF HEALTH AND HUMAN SERVICES CENTERS FOR MEDICARE & MEDICAID SERVICESFORM APPROVED OMB No. 09380832HEALTH INSURANCE BENEFIT AGREEMENT(Agreement with Provider Pursuant to Section 1866 of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pdffiller form

Edit your cms 1561 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cms1561 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cms 1561 is a form medicaid services cms online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cms form 1561. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1561 form

How to fill out CMS-1561

01

Begin by downloading the CMS-1561 form from the official CMS website.

02

Read the instructions carefully before completing the form.

03

Fill out the provider's information in Section 1, including name, address, and phone number.

04

In Section 2, provide all necessary details regarding the billing information.

05

Complete Section 3 by entering the services rendered and the corresponding diagnosis codes.

06

If applicable, fill out Section 4 regarding any prior claims.

07

Review all information for accuracy and completeness.

08

Sign and date the form at the designated section.

09

Submit the completed CMS-1561 form to the appropriate Medicare Administrative Contractor.

Who needs CMS-1561?

01

Healthcare providers who submit claims for services rendered to Medicare beneficiaries.

02

Facilities and organizations that need to provide information for payment purposes under Medicare.

03

Any entity seeking reimbursement for services covered by Medicare.

Fill

health care provider form

: Try Risk Free

People Also Ask about form 1561

What is a CMS 671 form?

CMS 671. Form Title. LTC Facility Application for Medicare/Medicaid.

What is the difference between CMS and Medicare?

In short, No. The Centers for Medicare and Medicaid Services (CMS) is a part of Health and Human Services (HHS) and is not the same as Medicare. Medicare is a federally run government health insurance program, which is administered by CMS.

What is CMS in healthcare?

Centers for Medicare & Medicaid Services.

What is the difference between CMS and Medicaid?

The CMS oversees programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces. CMS collects and analyzes data, produces research reports, and works to eliminate instances of fraud and abuse within the healthcare system.

What is CMS 460 Medicare form?

CENTERS FOR MEDICARE & MEDICAID SERVICES. INSTRUCTIONS FOR THE MEDICARE PARTICIPATING PHYSICIAN. AND SUPPLIER AGREEMENT (CMS-460) To sign a participation agreement is to agree to accept assignment for all covered services that you provide to Medicare patients.

What is CMS 1572?

The CMS-1572 form is used by State Survey Agencies (SAs) when surveying Home Health Agencies (HHAs) and to collect information about an HHA. These regulations were created by CMS under the authority of sections 1861(o) and 1891 of the Social Security Act (“the Act”).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit how to fill out cms 1561 for services covered by medicare straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit department of health and human services centers for medicare medicaid services forms.

How do I fill out how to fill out form cms 1763 using my mobile device?

Use the pdfFiller mobile app to complete and sign cms health plan on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete benefit agreement on an Android device?

Complete your medicaid signature form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CMS-1561?

CMS-1561 is a form used by healthcare providers to report their Medicare cost report and other related financial information to the Center for Medicare & Medicaid Services (CMS).

Who is required to file CMS-1561?

Healthcare providers that participate in the Medicare program and receive Medicare reimbursement for services rendered are required to file CMS-1561.

How to fill out CMS-1561?

To fill out CMS-1561, providers must gather necessary financial data, such as revenue, expenses, and service descriptions, and then input this information into the appropriate sections of the form according to the provided instructions.

What is the purpose of CMS-1561?

The purpose of CMS-1561 is to collect accurate financial data from healthcare providers to ensure proper reimbursement and to facilitate the oversight and evaluation of Medicare services.

What information must be reported on CMS-1561?

Information that must be reported on CMS-1561 includes total revenue, operating expenses, services provided, cost of services, and any other financial data required by CMS for reimbursement and reporting purposes.

Fill out your CMS-1561 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Health Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to medicare 855i

Related to cms title

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.